Chapter Twelve

Why Genius Failed and No One Noticed.

The difference between genius and stupidity is that genius has its limits.

Albert Einstein (1879-1955).

Genius.

Chapter Highlights

This chapter will be narrowly focused because the implications of what arose in the sorry story it relates did not have the same long-term systemic impact on globalization dynamics as the chapters which precede it. But it should have been more widely noticed.

In the passages that follow, I have no option but to include words and concepts from the lexicon of financial economics. These will be kept to a minimum because they mustn’t distract from the book’s purpose, which is to highlight significant historical events, processes, themes and globalization dynamics that define our decade. And to make sense of them.

The story I tell may cause some confusion and a heavy dose of incredulity. Confusion because the issues are complex, and economists are notoriously fractious in how they conduct and communicate their ‘dismal science’. Disbelief because the central characters employed by the company I scrutinise, Long Term Capital Management (LTCM), are Nobel prize winners who should have known better when doing what they did.

But we can seek solace that we are in good company, the genuine genius Sir Isaac Newton (1643-1727), mathematician, astronomer, physicist, theologian, lockdown philosopher etc., who caustically observed (having made a fortune in stocks before promptly losing it again):

I can calculate the motions of heavenly bodies but not the madness of money.

With these observations made, let’s take a (random) walk down Wall St., the beating heart of global capitalism, which opened chapter one: “Greed is good”.

The Efficient Market Hypothesis

Traditional financial economics argues that it is impossible for investors to ‘outperform’ asset markets, a theorem known as the Efficient Market Hypothesis (EMH). Numerous scholarly research projects (and some frankly frivolous but fun experiments involving Florida ‘seniors’ and, separately, monkeys) have demonstrated that highly-paid Wall St. and City of London fund managers are not worthy of the generous remuneration packages they receive.

In both finance and economics, behavioural sciences are in the ascendency, challenging fundamental theories associated with the EMH and other aspects of behavioural economic life, perspectives ranging from Nobel-laureate-academic to lightweight-facetious. Also, please take note of John Maynard Keynes’s oft-cited observation that “the market can stay irrational far longer than you or I can remain solvent”.

Monkeys are frequently used in experiments relating to ‘stock-picking’ to challenge the idea that any individual investor – or highly-paid fund manager – can outperform the stock market by being smarter than the mammal; time after time, the monkey wins. Applying this concept to Donald Trump’s hotel, casino and resorts business for the decade following 1995, iconic investor Warren Buffet observed: “If a monkey had thrown a dart at the stock page, the monkey, on average, would have made 150%”. Investors in Trump’s business, he noted, lost 90 cents on every dollar during the same period

Monkeys are frequently used in experiments relating to ‘stock-picking’ to challenge the idea that any individual investor – or highly-paid fund manager – can outperform the stock market by being smarter than the mammal; time after time, the monkey wins. Applying this concept to Donald Trump’s hotel, casino and resorts business for the decade following 1995, iconic investor Warren Buffet observed: “If a monkey had thrown a dart at the stock page, the monkey, on average, would have made 150%”. Investors in Trump’s business, he noted, lost 90 cents on every dollar during the same period

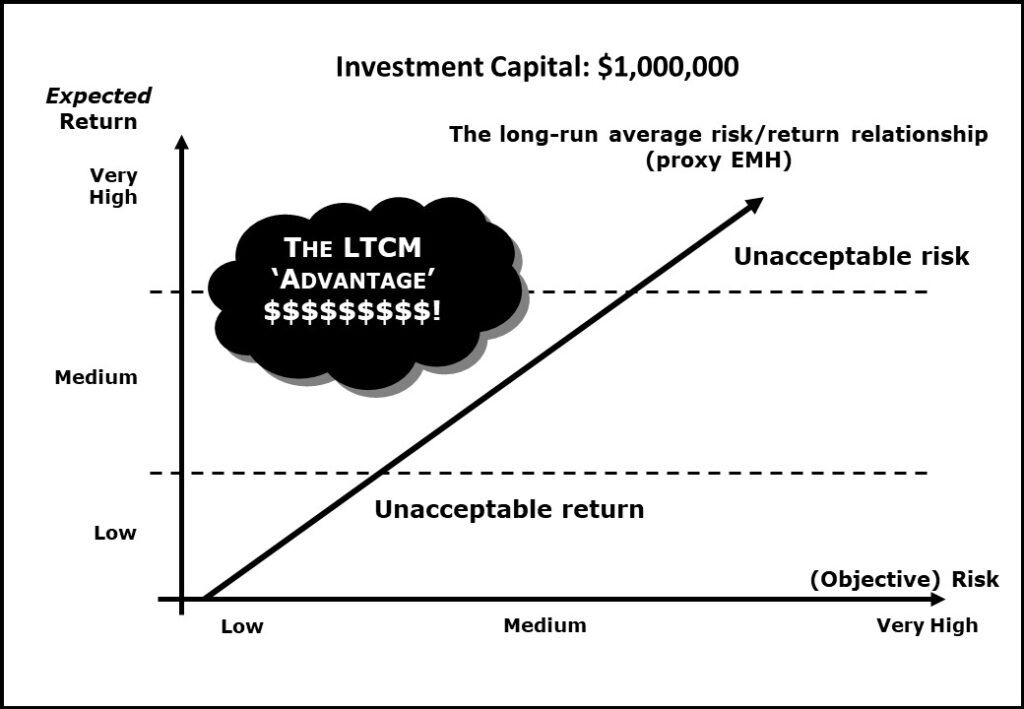

The illustration below presents a proxy for EMH, graphically demonstrating the three interacting elements of finance and investment theory:

-

-

- Investment.

- Risk.

- Expected Return.

-

Let us assume that investment capital is a fixed amount, say, $1m. Risk is presented here on the horizontal axis as an objective factor, a proxy for broader market acceptance of the risk associated with any asset class or portfolio. The emphasis on expected return as depicted on the vertical axis relates to the behavioural dimension of investment theory, i.e. it describes the motivation underpinning investment decisions made by an individual or group of like-minded investors.

So, for example, why would someone invest in a very high-risk project? Cynically stated, they are greedy, like fictional character Gordon Gekko (“greed is good”) or the very real Jordan Belfort, the Wolf of Wall Street.

Or they have animal spirits, “a spontaneous urge to action” (attrib. John Maynard Keynes). Or they are caught up in the bubble-blowing madness of crowds (attrib. Charles Mackay). Or they are consumed by irrational exuberance (attrib. Robert Shiller). Or they think they are smarter than the market (e.g. Profs. Merton and Scholes of LTCM). Or they are deluded. Or, less critically, because they know what they are doing, can afford to play the game and are prepared to lose their money (e.g. Wayne Rooney).

Reverting to the EMH illustration above, I have refrained from naming specific asset classes, but I can provide generalised examples along the horizontal (objective) risk axis, from lowest to highest.

Low: the lowest-risk asset class in this category is sovereign debt (bonds) issued by stable, advanced economies, e.g. US Treasuries, UK Gilts, German Bunds, French OATs etc. Cash-in-the-bank is the most common ‘mass-market’ example in this category. Still, bank deposits do come with a risk caveat: the notion of moral hazard and the principle that banks must be allowed to go bankrupt to constrain their lending behaviour. ‘Blue-chip’ corporate bonds (debt) would also feature within this low-risk spectrum, towards its higher end.

Medium: the typical profile here would be of a balanced, diversified portfolio of cash (for liquidity), bonds (for income) and equities (for liquidity, income and capital gain). The biggest risk investors take here is the potential loss of capital. A large majority of the general public will be invested in this risk category, primarily through their long-term savings for retirement and mainly through statutory pension funds. Most ‘active’ fund managers will earn their living from managing these investment portfolios. Most funds will be linked to a stock-market index, e.g. FTSE 100/250, Dow Jones, S&P, CAC, DAX, Nikkei, Nasdaq etc. Taking the US as an example, blue-chip, dividend-paying, relatively safe (‘old economy’) companies are typically listed on the S&P 500. The FAANGs (Facebook- now Meta – Apple, Amazon, Netflix, Google – now Alphabet) represent riskier, higher growth-focused companies and are primarily listed on Nasdaq.

Very High: tulips from Amsterdam; the millennium dot.com casino; the sub-prime slice & dice (as seen in the award-winning docu-drama movie, The Big Short); the bitcoin bonanza; the unquoted biopharma equity stock-picker; etc.

I conclude this discussion of ‘the madness of money’ with another aphorism from Warren Buffet:

I will tell you how to be rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.

All of which brings us to our main feature: the rise and fall of Long Term Capital Management.

Long Term Capital Management

The title of this chapter is unashamedly borrowed and adapted from the international best-selling book by Wall Street Journal reporter and author Roger Lowenstein (2002): When Genius Failed: The Rise and Fall of Long-Term Capital Management (How One Small Bank Created a Trillion-Dollar Hole). The company concerned is Long Term Capital Management (LTCM), registered in Delaware but headquartered in Greenwich, Connecticut.

LTCM was founded in 1994 as a hedge fund management firm (to circumvent regulation) by John Meriwether, the former vice-chairman and head of bond trading at Soloman Brothers during the heady days of the late 1980s. The geniuses are two famous scholars noted for their econometric modelling of markets and managing assets via leverage and hedging to provide their wealthy clients with (promised) above-normal returns (depicted as the LTCM ‘Advantage’ in the EMH illustration above). These were the quants, the ‘Masters of the Universe’.

The professors were Myron Scholes and Robert Merton. They were awarded The Nobel Memorial Prize in Economic Sciences in 1997 for their contribution to the creation of the Black-Scholes model, a conceptual framework for valuing derivatives, including options such as ‘calls’ or ‘puts’ (continuous-time options pricing) amongst other ‘tricks of the (dismal science) trade’ of financial economics.

Reflecting on the discussion in the previous chapter and the economic tsunami crossing continents, while countries such as Thailand, Indonesia and Malaysia were relatively ‘small fish’ in the grand scheme of global finance, Russia was a different prospect. It has vast natural resources, massive nuclear capability and a centralised and highly politicised macroeconomic management system.

Along with other supposedly hedged trading positions, LTCM had invested heavily in Russian local currency bonds but left itself horribly exposed to a ‘liquidity trap’ when Russia defaulted, a problem compounded by similarly misjudged investments in complex financial derivatives and apparently ‘safe’ corporate bonds. For example, the fund had invested heavily in Fiat bonds, assuming that the Italian automobile manufacturer had the same low-risk profile as ‘blue chip’ stocks such as US firms IBM, The Coca-Cola Company and GE.

The liquidity trap scenario is both incredibly simple and horrendously complex to explain within the subject domain of financial economics. Let’s deal with the simple aspect first. Cash is king, which is a proxy for liquidity. If you are heavily in debt and have an unexpected ‘cash call’, say for funeral expenses, you can’t afford the cost: pay-day loans loom large.

Reverting to LTCM, the complexity shouldn’t have concerned investors because their trust was placed in the famous professors to handle it, two Nobel laureates with their magic models for hedging bets and taking care of their clients’ cash. But no amount of quantitative analysis could predict the enigmatic nature of Russian government behaviour or, indeed, the intricate political relationship between the Italian government and Fiat, another investment made (corporate bonds) by LTCM.

So the real question should be why genius failed, not when. The latter is easy: 1998, the end of our turbulent decade. The former is equally straightforward: hubris in the form of excessive self-belief to the extent that the professors just kept digging that financial black hole when faced with mounting evidence that it was getting deeper. As former French President Charles de Gaulle pithily observed, “Genius sometimes consists of knowing when to stop”.

Following the Asian Financial Crisis and the Russian sovereign debt default, and with a growing realisation that bigger banks with deeper pockets were mirroring their trades and cashing out, LTCM was busted, and the genius professors knew it. In short order, losses accumulated to $4.6bn and the piggy bank was emptied of its moolah. For financial geeks, here is where the cash evaporated; for laity, it doesn’t make a difference — what happened next is what matters most:

-

-

- $1,6bn in swaps.

- $1.3bn in equity volatility.

- $430mn in Russia and other emerging markets.

- $371mn in directional trades in developed countries.

- $286mn in dual-listed company pairs which entice arbitrage, for example, Shell, which has separate listings in London and Amsterdam (Class A and Class B equities).

- $215mn in yield curve arbitrage (a bond ‘thing’).

- $203mn in S&P 500 stocks (puts, calls, shorts, longs and the rest).

- $100mn in junk bond arbitrage.

-

The fund had collapsed abruptly, marking the most extensive single fund failure in the history of market capitalism and the investment industry up to that point in time. Reverting to this chapter’s title, the reason that ‘no one noticed’ is because that is the way the New York financial sector wanted it to be. ‘Encouraged’ by the Federal Reserve of New York, which was seeking creditor involvement in a rescue, the industry rallied around and bailed itself out.

With LTCM, greed was back, and it would return, along with its companion and enabler, moral hazard. But that is in another decade and for a different book.

Please click/tap your browser ‘Back’ button to return to the location navigated from. Alternatively, click/tap the ‘The Long March of Globalization’ graphic below to navigate to the Ten Years… The Book page.

All content © Colin Edward Egan, 2022