Chapter Eight

Inside Fortress Europe and the ‘1992 Process’.

The difference between perseverance and obstinacy is that one comes from a strong will, and the other from a strong won’t.

Henry Ward Beecher (1813-1887).

Congregational clergyman, social reformer, abolitionist.

Chapter Highlights

With China evolving, Japan wilting and the US nursing its debt hangover, twelve European states were planning the final stages of the biggest Euro-project since the Treaty of Rome was ratified in 1957.

Even earlier, the 1951 Treaty of Paris between France, West Germany, Italy and the three Benelux countries (Belgium, Netherlands and Luxemburg) established the European Coal and Steel Community and laid down the foundations for the European Union (EU), which came into being on January 1st 1993.

The United States of Europe? A Brief History of a European Union

The dream of European unity has a long history. It had liberal and pacifist roots, ideals that floundered in the face of self-destructive, violent interruptions. Intellectual calls for European integration have followed a turbulent path. Though the famous ‘Grand Design’ attributed to Henry IV of France (1553-1610) is of dubious origin – as such fables tend to be – its legend explicitly referred to a ‘Great Republic of Europe’. This entity would join together the disparate kingdoms, principalities and religions of Europe and harness them in peaceful unity.

In their 1814 tract De la réorganisation de la société européenne (The Reorganisation of European Society), Henri de Saint Simon (1760-1825) and his doctoral pupil Augustin Thiery (1795-1856) called for the unification of Europe on the basis of a single constitution. Their thesis emphasised the principle of a European democratic parliament independent of nation-states and empowered to take mediatory action.

Italian philosopher Carlo Cattaneo (1801-69) linked people-to-nation-to-state-to world citizenship through his notion of what is now known as subsidiarity, the principle that a central authority should only have a subsidiary function, performing those tasks which cannot be performed at a more local level.

(Subsidiarity is a central tenet of today’s European Union and a constant source of tension among its member states).

Despite their lofty ambitions, such appeals were largely ignored. Europe instead became a continent of nation-states that were individually reluctant to tolerate their dominant neighbours. War and rebellion became the means of solving national-territorial and hereditary disputes as Europe’s constituent countries amassed a significant competitive advantage in killing and maiming, mostly each other.

Western European nations were in constant strife from 1550 to the eventual (yet still fragile) peace of 1945. Warmaking and warmongering became the engine of industrial and economic development, the driver of political policy and the glorification of man’s noblest instincts and chivalry. Rather than united, the continent of Europe has been restless, fragile, contradictory and pluralist. European unity was the dream, disunity its apparent destiny.

The 1992 Process

For many years it had become common parlance to discuss the ‘1992 Process’ but, as with many things European, events did not quite tally. The formal creation of the European Single Market was on January 1st 1993.

The first-of-the-first-in-the-year is typical for the commencement of major European projects. For example, the then-controversial single currency, the Euro, was officially introduced as an accounting medium of exchange to global financial markets on January 1st 1999, i.e. in the first instance, it existed exclusively as a technical concept with only electronic exchange and transfers being possible. The cash – notes and coins – didn’t arrive until January 1st 2002. Unofficially, the governments of France, Belgium and the Netherlands put massive pressure on retailers to postpone their January sales until the new currency had ‘bed-in’, this for fear of the ATMs being empty when consumers traditionally let in the New Year with their annual retail therapy!

This Euro trivia may well be Euro-trash, but it was a serious political detail: the same-day launch of a multi-country single currency, in the absence of fiscal (tax) harmonisation, had never been done before, and there was wide and deep scepticism that it would work.

The twelve European Community countries who became signatories to the Single European Act of 1986 (ratified and effective July 1st 1987) to formalise a European Single Market by the end of 1992 were:

-

-

- Belgium.

- Denmark.

- France.

- Germany.

- Greece.

- Ireland.

- Italy.

- Luxemburg.

- Netherlands.

- Portugal.

- Spain.

- United Kingdom.

-

When writing the first edition of this book in 2018, there were twenty-eight member states within the European Union, with one about to leave (the UK) and others patiently queuing to join in the fun (e.g. North Macedonia, Serbia, Turkey).

One of the factors Prof. Michael Porter identified in explaining the competitiveness of nations was the extent to which national industries were themselves characterised by intense rivalry. In the run-up to the European Single Market, the characteristic attitude of large national firms from France, UK, Netherlands and, to a lesser extent, Germany, was exactly that: nationalistic; or, perhaps more accurately, country-parochial; or, and worse, xenophobic. Rather than competing or consolidating, national firms spent energy and resources extensively lobbying their respective governments to protect their privileged positions.

The case of Germany in this context is worthy of particular note. On a GDP per capita basis, Germany was then the world’s largest exporter of manufactured goods, and it remains so to the present day. Underpinning this powerhouse performance are not only the usual suspects: VW, Bosch, Daimler, BMW, Siemens, Henkel, Bayer and so on. The driving force of German export success is the Mittelstand, ‘no-name’ small and medium-sized engineering companies who dominate global high-end business-to-business niches, typically employing less than 500 people and mostly family-owned.

In its 1990 annual paper on the World Economy, Japan’s Economic Planning Agency pointed to the proposed North American Free Trade Agreement (which embraced Canada in the north and Mexico to the south) and the European Single Market, and predicted a potential shrinkage in world trade:

The possibility of raising barriers against countries outside the union cannot be denied. We must be vigilant against such a tendency.

More generally, there was a growing fear amongst many economists and commentators that the emerging trade blocks were more likely to operate as ‘Fortress America’, ‘Fortress Japan’ and ’Fortress Europe’ than as a spur to driving growth in the world economy.

Japanese concern was not surprising, although the constraint shown in the politeness of the report perhaps was. Japan’s response to the emerging trading bloc mentality was in stark contrast to the caustic nature of the attacks on the Japanese at the time by the former French Prime Minister, Edith Cresson, a highly divisive figure in European politics throughout the 1990s:

The Japanese have a strategy of world conquest. They have finished their job in the US, and now they are about to devour Europe.

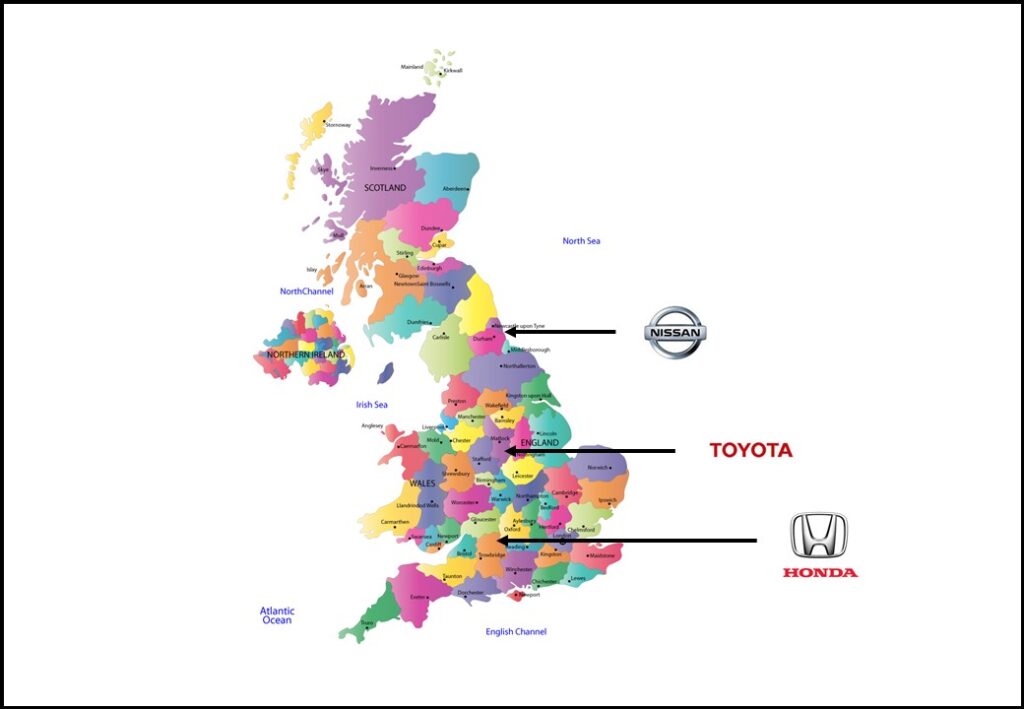

However, the French position does need to be put in a broader perspective. The UK, for instance, didn’t follow the same hard-line xenophobic attitude, a point which commentators argued reflected the fact that Japanese companies had placed 40% of their European foreign direct investment (FDI) in the UK. High profile examples were the car giants Toyota, Nissan and Honda, as depicted in the illustration below.

For non-Anglophiles looking at the map above, Honda located its manufacturing facilities in Swindon, Toyota in Derby and Nissan in Sunderland. Arguably, Toyota made the smartest location choice: Derby is the home of Rolls-Royce Aerospace and Canadian engineering company Bombardier Transportation. The city, its universities, colleges, and even its schools exist within a cutting-edge precision-engineering culture.

For non-Anglophiles looking at the map above, Honda located its manufacturing facilities in Swindon, Toyota in Derby and Nissan in Sunderland. Arguably, Toyota made the smartest location choice: Derby is the home of Rolls-Royce Aerospace and Canadian engineering company Bombardier Transportation. The city, its universities, colleges, and even its schools exist within a cutting-edge precision-engineering culture.

The Japanese solution to the dual-issue business case scenario of a strong currency (¥) and unit import quotas was deceptively simple, although it required a long-term planning horizon: manufacture the mainstream high-volume brands inside the walls of Fortress Europe to get around the quota impositions and export the higher value-per-unit products such as Lexus to extract maximum margins from those markets.

Perhaps more illuminating as 1993 approached (and daunting for some European, Japanese and American companies) was the German stance against protectionist measures at the time: it was fervently against them. This position reflected their conviction that German companies could take on and beat their Japanese and other global rivals by any measure of customer value. The evidence was with them rather than those advocating protectionism, and that is how it played out in the decades which followed.

Harvard economist Michael Porter has convincingly argued that the intense rivalry of competing firms in a global industry was highly likely to lead to continuous product and process innovation and competitive success.

As he also noted in a rare author-named guest essay in The Economist, Europe’s Companies after 1992: Don’t collaborate, compete, the tendency of European firms to collaborate or clamour for protection during the approach to what was the inevitability of the European Single Market, rather than taking on the business environment challenges it presented them with, would fail. His message was simple:

The secret of competitive advantage is to compete.

Please click/tap your browser ‘Back’ button to return to the location navigated from. Alternatively, click/tap the ‘The Long March of Globalization’ graphic below to navigate to the Ten Years… The Book page.

All content © Colin Edward Egan, 2022